During the manufacturing process, we have different production costs that affect the overall cost of your product. Our last post went into a bit more detail and looked at how both variable and fixed costs have an effect on production. Another cost that plays a role in your product quote is your manufacturing overhead cost.

Manufacturing Overhead

According to Account Coach, manufacturing overhead “includes the costs incurred in the manufacturing facilities other than the costs of direct materials and direct labor. Hence, manufacturing overhead is referred to as an indirect cost.”

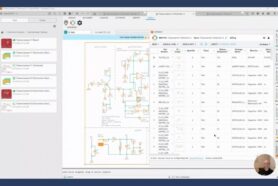

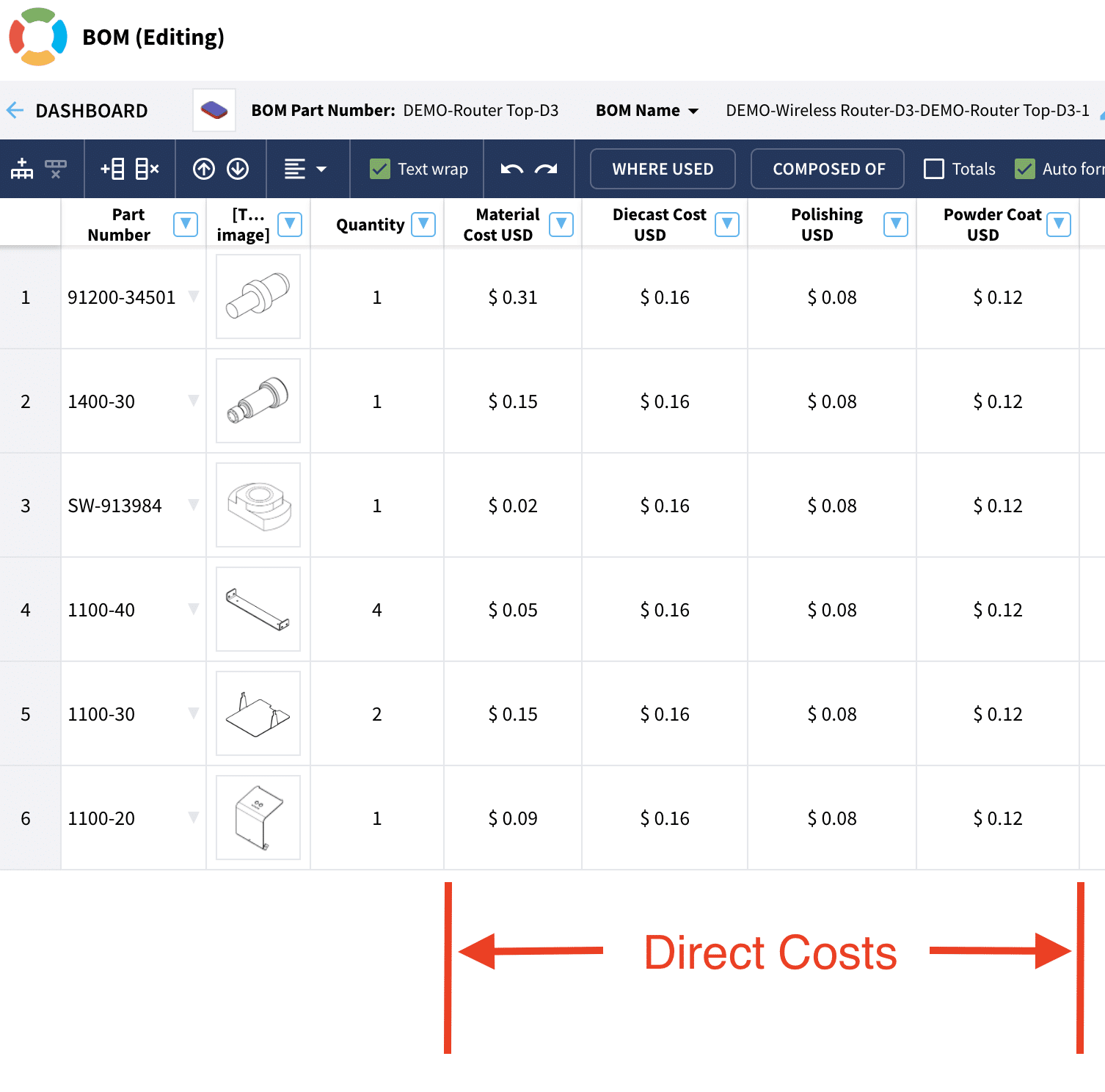

For a quick recap, direct costs (not considered manufacturing overhead costs) include both labor and raw materials needed to build a product. The BOM below captures the direct costs during quotation.

Types of Manufacturing Overhead

Since manufacturing overhead covers all indirect costs related to production, there are quite a few categories. These include the security when you visit your supplier, the utilities, the salaries for all indirect employees, depreciation, indirect equipment, and more.

Rent & Utilities

Rent might not be a concern if you own the facility. However, if you are renting it then you will need to calculate this. Here is a list of other expenses:

- Water

- Phone

- Gas

- Electricity

- Rent

Indirect Labor

Indirect labor includes the salaries of all employees that are not involved with making the product. In other words, everyone that is not touching a product during mass production, such as:

- Employees of the engineering, supply chain, project management, finance, HR, and other teams not involved with assembling/fabricating parts.

- Management & Executives

- Supervisors (Production & Quality)

- Security

- Janitors

- Maintenance

Indirect materials & equipment

These expenses include all of the supplies on the production floor and office that are not on the Bill of Materials (BOM). Indirect equipment includes tools that are not made specifically for the product in production. These include the following:

- Tables & Desks

- Power Tools & Hand Tools

- Quality Tools

- PPE

- Computers

- Cleaning suppliers

If there is an expense that arises for a particular part, such as welding fixtures or plastic injection tools then these are not indirect materials & equipment. This is an investment that the client needs to pay for.

Depreciation

Instead of realizing the cost for a specific asset in a single year, you can spread it across the lifetime of the asset. In other words, depreciation indicates the amount of value an asset has used up. You can use this to match the cost of an asset with the dollar value that the same asset brings in within a specific time frame. Here are different types of depreciation.

- Equipment

- Real Estate

- Machines

- Vehicles

Other Costs

Other costs will be those that you can not categorize in the costs listed above. These consist of the following:

- Taxes

- Insurance

- Legal

- Travel

- Marketing

- Audits

It is also important to understand how to calculate these costs. Incorrectly calculating overhead will either hurt your margins or offer a price too high so you are not competitive.

How can we Help?

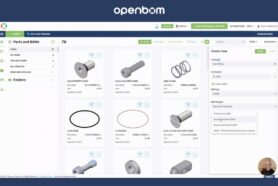

In the last couple of years, we’ve had part inflation and part shortages. As a result, manufacturing companies have been forced to source multiple alternative components while tracking the prices for all components. This has created managing your data in spreadsheets chaotic. The solution is OpenBOM.

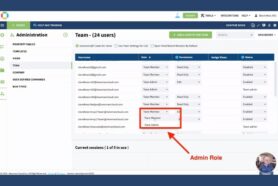

OpenBOM is a cloud-based platform to manage your engineering and manufacturing data. Companies from startups to Fortune 500’s use OpenBOM to create a centralized database to bring in, store and manage their manufacturing data. With this infrastructure, users also use OpenBOM to streamline both their change management and PO processes.

If you need to improve the way you manage your data and processes, contact us today for a free consultation.

Regards,

Jared Haw

Join our newsletter to receive a weekly portion of news, articles, and tips about OpenBOM and our community.