Companies of all sizes need to take their manufacturing strategies seriously and for startups and small to medium enterprises (SMEs), their contract manufacturing partner or supplier base can put them in a rut. Depending on the industry, most manufacturers have their contract manufacturer (CM) or sub-suppliers in China. How can you not with their promises of cost-effectiveness, technological expertise, and unparalleled scalability?

The country’s vast industrial infrastructure, along with its labor force, presents an enticing proposition for businesses looking to bring their ideas to fruition at a fraction of the cost they might incur domestically or in other regions.

When looking for CMs and suppliers, it’s nearly impossible to overlook China. Even if you are working with a local supplier the chances they are using suppliers in China for components or sub-assembles is very high. Here are the top five reasons manufacturers are sucked into manufacturing their products in China:

- Cost-Effectiveness

- Technological Expertise

- Scale & Flexibility

- Access to Skilled Labor

- Integration into the Supply Chain

And if we need one more, everyone else is going to China as well.

However, things are not always as they seem. In this blog, we will highlight the top five reasons startups and SMEs inadvertently put their business at risk by choosing the wrong CM in China.

Top 5 Reasons Companies Choose the Wrong Suppliers

Despite the promises of manufacturing in China, the journey has some challenges, especially when it comes to selecting the right suppliers. Many startups and SMEs stumble in this critical aspect, often opting for suppliers that ultimately prove to be ill-suited to their needs. Here are the top five reasons why companies choose the wrong suppliers:

Price, Price & Price

One of the biggest challenges faced by startups and SMEs when manufacturing in China is the overemphasis on price as the primary determinant in selecting suppliers. In a competitive global marketplace, companies are under constant pressure to minimize production costs and maximize profit margins. As a result, the temptation to prioritize the lowest bid or quote can be compelling, especially for businesses operating on tight budgets or facing intense pricing pressures.

While cost-effectiveness is undoubtedly a critical consideration in supplier selection, focusing solely on price can have detrimental consequences for companies in the long run.

Lack of Proper Supplier Vetting

One of the critical missteps often encountered by startups and SMEs when venturing into manufacturing in China is the lack of thorough supplier vetting. In the rush to initiate production and bring products to market expediently, companies may forego essential due diligence processes, opting instead for shortcuts that can have far-reaching implications for their operations and reputation. Here are some key reasons why the lack of supplier vetting poses significant challenges:

- Limited understanding of supplier capabilities

- Inadequate assessment

- Overdepenecy on the contract

- Lack of insight into reputable and past performances

Misalignment of Expectations

One of the pervasive challenges encountered by startups and SMEs when engaging in manufacturing partnerships in China is the misalignment of expectations between the company and its suppliers. Clear and transparent communication is essential for fostering productive collaborations, yet misinterpretations, assumptions, and divergent priorities can lead to discord and frustration.

Startups and SMEs also have ambitious goals. These are reflected when it comes to building an early relationship with suppliers. When reality sets in and the orders are lower, the CM and suppliers can hold some resentment and maybe not offer the services they were once offering because the order size does not warrant the level of support they receive. This will lead to a decline in happiness from the manufacturer.

Ignoring Warning Signs

One of the critical mistakes made by startups and SMEs when engaging in manufacturing endeavors in China is the tendency to overlook warning signs indicating potential issues with their suppliers. These warning signs, if ignored, can escalate into significant challenges and disrupt the manufacturing process.

While some of these warning signs can be valid, some of them are just excuses for mistakes. Here are some of the top warning signs:

- Missed Deadlines

- Inconsistent Quality

- Lack of Transparency

- Declining Performance

Failure to Diversify Suppliers

One of the critical mistakes that startups and SMEs often make when manufacturing in China is the failure to diversify their supplier base. Overreliance on a single supplier, no matter how reliable or cost-effective, exposes companies to a multitude of risks and vulnerabilities.

Diversifying suppliers can be challenging, especially for startups that might not have the demand to keep both suppliers busy and able to meet their minimum order quantities (MOQs). However, diversification makes it more simple for manufacturers to pivot. If your supply chain is not diversified then you’ll be stuck with underperforming suppliers longer than necessary.

Here are additional reasons why not diversifying your supply can pose challenges.

- Vulnerability to supply chain disruptions

- Limited leverage in negotiations

- Inability to scale and adapt to changing demands

Conclusion

The journey of manufacturing in China presents startups and SMEs with a wide range of opportunities, challenges, and risks. If manufacturers do not properly evaluate their suppliers then this can lead to a sour relationship that is difficult to get out of and fix.

By acknowledging the realities of manufacturing in China and adopting proactive strategies to mitigate risks, companies can position themselves for success in the global marketplace. Thorough due diligence in supplier selection, transparent communication, robust quality control measures, and strategic supplier diversification are essential elements of a resilient and sustainable manufacturing strategy.

In the dynamic and ever-evolving landscape of global manufacturing, startups, and SMEs must remain vigilant, adaptable, and forward-thinking. By embracing the opportunities and challenges of manufacturing in China, companies can harness the full potential of one of the world’s most dynamic manufacturing ecosystems, driving sustainable growth, and creating value for stakeholders in the years to come.

By: Jared Haw

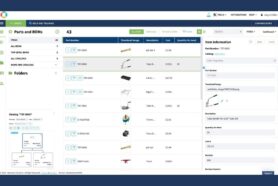

Join our newsletter to receive a weekly portion of news, articles, and tips about OpenBOM and our community.